In the complex world of personal finance, saving money and accessing credit can be significant challenges, especially for individuals with limited access to formal financial institutions. One time-tested method that has emerged as a powerful tool for financial empowerment is the Rotating Savings and Credit Association, commonly known as ROSCA. This post will explore why individuals participate in ROSCAs and highlight the benefits of joining Consulytica’s innovative ROSCA program, The Community Rotating Savings Circle.

What is a ROSCA?

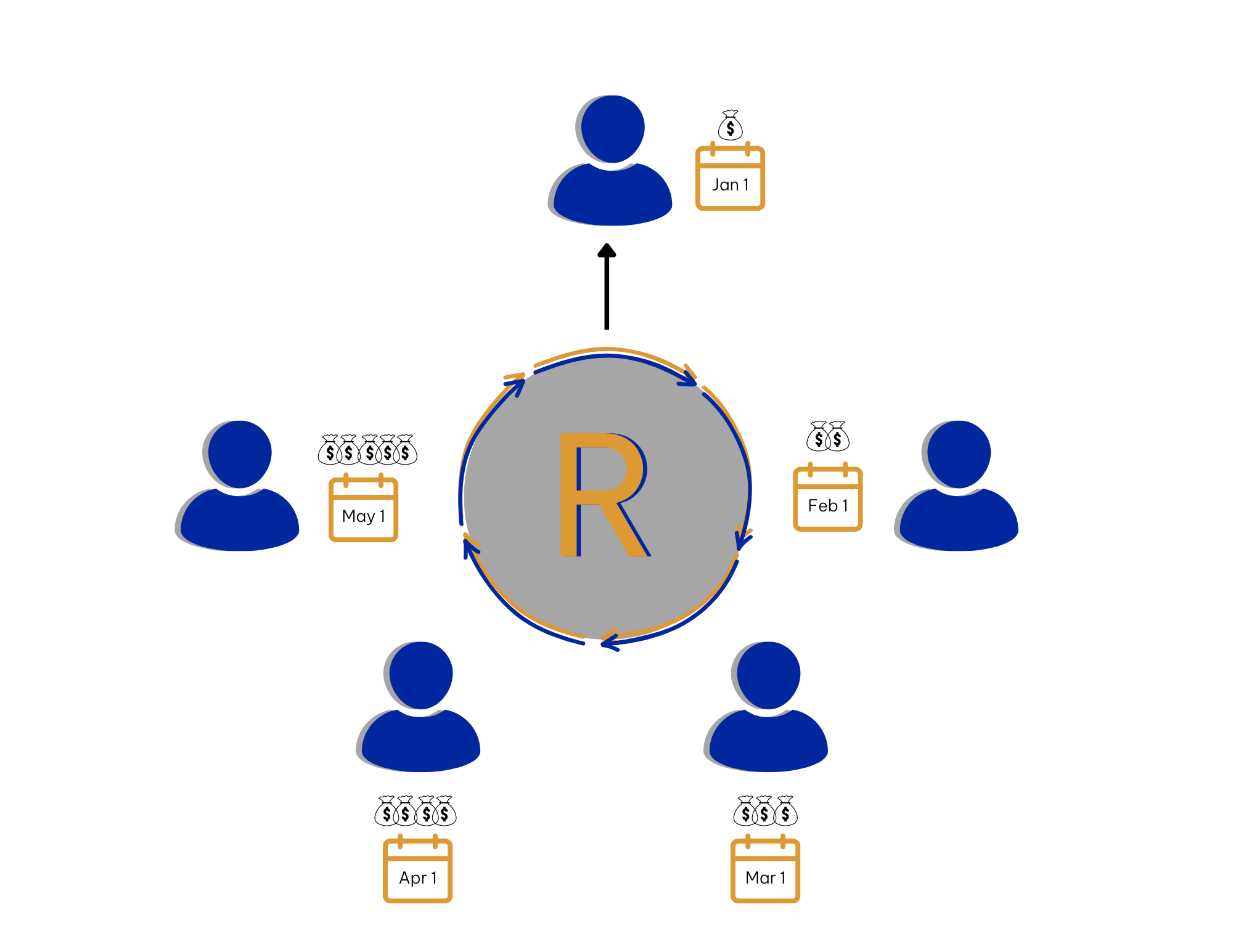

A ROSCA is a group of individuals who come together to pool their money and take turns receiving the collective sum. Each member contributes a fixed amount of money into the pot during each meeting, and at each meeting, one member collects the entire pot. This cycle continues until all members have had a turn to receive the lump sum.

Why Do Individuals Participate in ROSCAs?

- Access to Lump Sums of Money:

- Immediate Needs: ROSCAs provide members with a lump sum of money that can be used for significant expenses such as medical bills, school fees, or starting a small business. This is particularly beneficial for individuals who might struggle to save a large amount on their own.

- Investment Opportunities: Receiving a lump sum can enable participants to invest in opportunities that might otherwise be out of reach, such as purchasing equipment for a business or making home improvements.

- Community Trust and Support:

- Social Cohesion: ROSCAs are often formed among friends, family, or community members, fostering a sense of trust and mutual support. The social aspect of ROSCAs can be a powerful motivator for regular contributions and timely payments.

- Peer Pressure: The communal nature of ROSCAs means that participants are held accountable by their peers, which can encourage financial discipline and regular savings.

- Lack of Access to Formal Banking:

- Financial Inclusion: For individuals without access to traditional banking services, ROSCAs offer a practical alternative for saving money and accessing credit. This is particularly important in communities where banks are scarce or where individuals lack the necessary documentation to open a bank account.

- Financial Inclusion: For individuals without access to traditional banking services, ROSCAs offer a practical alternative for saving money and accessing credit. This is particularly important in communities where banks are scarce or where individuals lack the necessary documentation to open a bank account.

- Avoidance of High-Interest Loans:

- Debt-Free Finance: Unlike loans from banks or payday lenders, the funds received through a ROSCA do not come with interest or fees. This makes it a more sustainable and affordable option for many people.

The Benefits of Joining Consulytica’s Community Rotating Savings Circle

Consulytica has taken the traditional ROSCA model and adapted it to the modern world with its program, The Community Rotating Savings Circle. Here are some key benefits of participating in this program:

- Structured and Transparent:

- Organized Management: Consulytica’s ROSCA program is professionally managed, ensuring that all transactions are transparent and that the rotation schedule is adhered to strictly.

- Clear Rules: The terms and conditions are clearly defined, reducing the potential for misunderstandings or disputes among members.

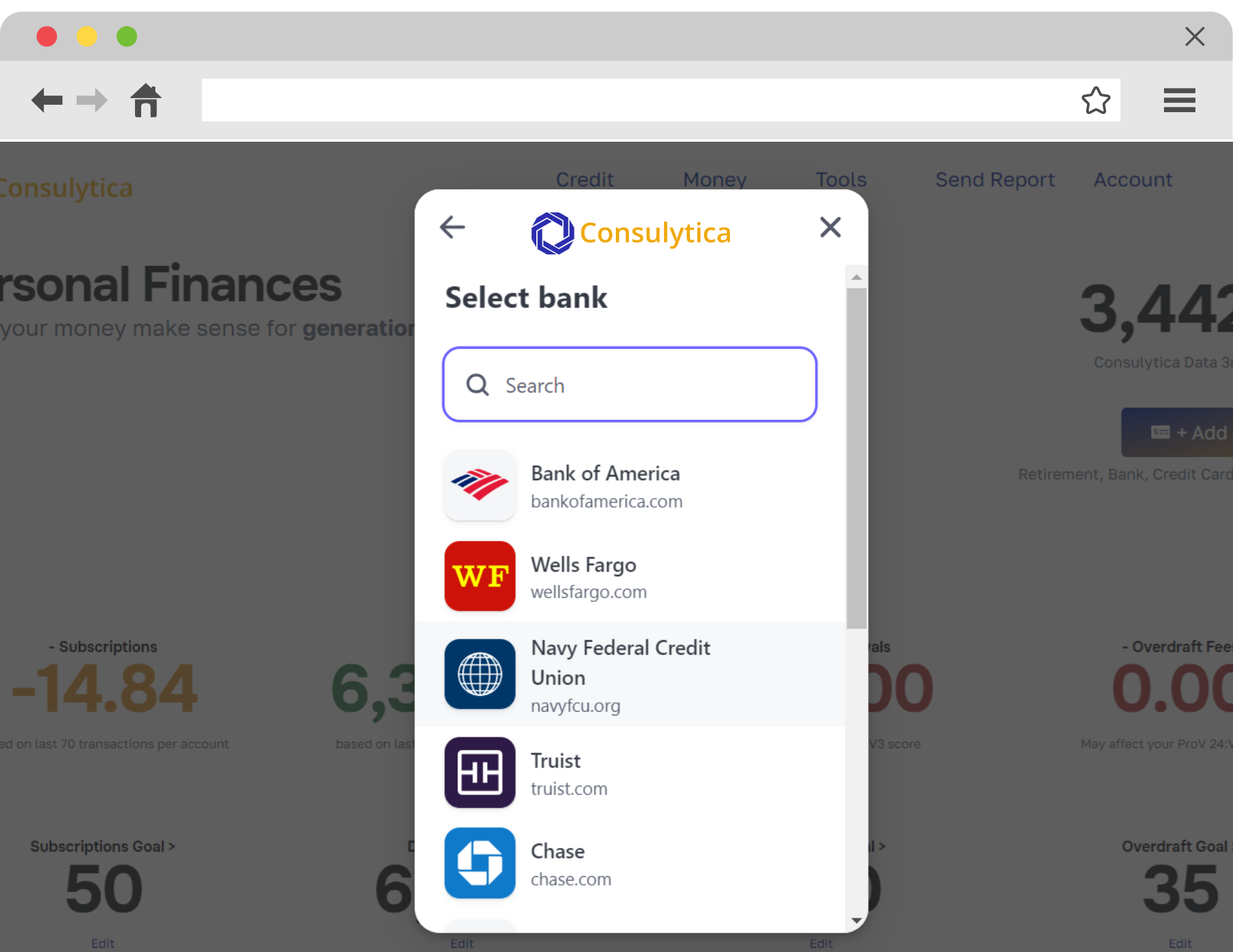

- Technology-Enhanced Experience:

- Digital Platform: The Community Rotating Savings Circle is facilitated through a user-friendly digital platform, making it easy for members to track their contributions and payouts. This also allows for automated reminders and updates.

- Secure Transactions: The platform employs robust security measures to protect members’ financial information and ensure safe transactions.

- Broader Network:

- Diverse Membership: By joining Consulytica’s ROSCA, participants can connect with a broader network of individuals beyond their immediate community. This can provide additional financial resources and opportunities for collaboration.

- Increased Opportunities: The larger the pool of participants, the greater the potential payouts, allowing for more significant financial planning and investment opportunities.

- Financial Education:

- Empowerment Through Knowledge: Consulytica provides educational resources to help members make informed financial decisions, understand the principles of saving and investment, and manage their finances more effectively.

- Empowerment Through Knowledge: Consulytica provides educational resources to help members make informed financial decisions, understand the principles of saving and investment, and manage their finances more effectively.

- Credit Building:

- On-Time Payments: One of the standout features of Consulytica’s ROSCA program is its ability to report on-time payments. Consistently making your contributions on time can positively impact your credit score.

- Credit History: Building a solid credit history is crucial for accessing other financial products, such as loans and credit cards, at favorable terms. By participating in The Community Rotating Savings Circle and maintaining a record of on-time payments, members can enhance their creditworthiness.

ROSCAs represent a time-honored approach to collective saving and lending, rooted in trust and community. They offer a viable financial solution for many individuals, particularly those who are underserved by traditional financial institutions. Consulytica’s Community Rotating Savings Circle enhances this model with modern technology, professional management, educational support, and credit-building opportunities, providing a structured, transparent, and flexible platform for financial empowerment.

Joining a ROSCA through Consulytica can help you achieve your financial goals, foster community connections, and build a foundation for a more secure financial future. Embrace the power of collective saving and take control of your financial destiny with The Community Rotating Savings Circle.