In today’s fast-paced digital world, it’s easy to overlook the simplicity and community spirit that once characterized everyday transactions. Decades ago, a person could walk into a neighborhood store, select the items they needed, and make the purchase on store credit, promising to pay later. It was a practice that fostered trust, community bonds, and economic empowerment. Fast forward to the present day, Consulytica is reviving these timeless values with innovative technology designed to harness data and lower the barriers to financial freedom.

The Neighborhood Store: A Beacon of Community

In the days of yore, neighborhood stores were not just places to buy goods; they were hubs of community life. Shopkeepers knew their customers by name and established a rapport built on trust. Store credit was an extension of this trust. It allowed individuals, often on modest incomes, to make purchases when funds were low, relying on their word to pay back later. The system created an atmosphere of cooperation and mutual support, underpinned by the belief that financial difficulties could be transient, and a helping hand from the community could make all the difference.

Consulytica: A Modern Approach to Community Values

Consulytica, a minority-owned fintech credit bureau headquartered in Richmond, Virginia, is on a mission to bring these cherished community values back to the forefront of financial transactions. While the world has evolved significantly since the days of neighborhood stores, the need for trust, accessibility, and community support remains as strong as ever.

Innovative Technology Meets Community Trust

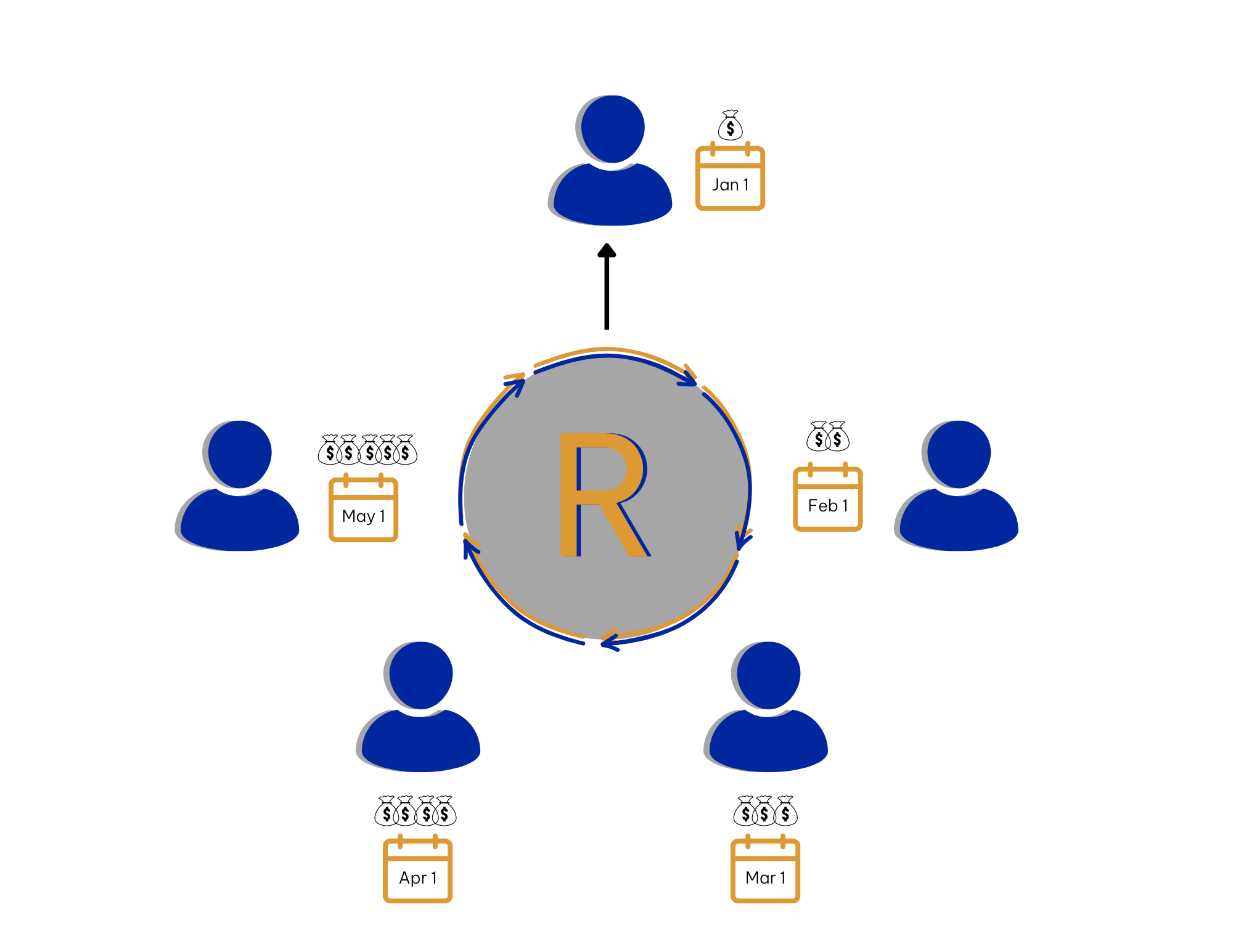

Consulytica’s groundbreaking approach combines innovative technology with community trust. Their proprietary credit scoring model, ProV 24:V3, takes into account a wide range of non-traditional data, such as insurance payments, retail credit accounts, utilities, and community tradelines. This data-driven approach allows for a more accurate and inclusive assessment of an individual’s creditworthiness. It’s a far cry from the limited data available to the neighborhood stores of old, and it serves to democratize access to financial services.

Personalized Credit Solutions

Just as the neighborhood stores extended credit to those they knew and trusted, Consulytica is committed to providing personalized credit solutions. Their approach recognizes the unique financial situations of individuals, whether they have a limited credit history, a low credit score, or other credit-related challenges. The aim is to empower people to take control of their financial lives and build a brighter financial future.

Lowering the Barriers to Financial Freedom

Consulytica understands that financial freedom should not be a privilege for a select few. They leverage their advanced technology to offer a fast, transparent, and affordable service that opens doors for individuals and communities. By embracing technology and data analytics, Consulytica is lowering the barriers to financial freedom, ensuring that everyone has the opportunity to achieve their financial goals.

Conclusion: Bringing Back Community Values with a Technological Twist

In an age of digital transactions and faceless financial institutions, Consulytica is stepping up to reintroduce the community values that have shaped our financial history. By merging innovation with trust and community-centric approaches, they are creating a future where financial empowerment is within reach for everyone. Just as the neighborhood store was a source of support and trust, Consulytica’s mission is to nurture a new era of community-oriented finance, one that leverages technology to serve and support individuals and communities in their pursuit of financial freedom. In doing so, they’re not just reviving an age-old concept; they’re shaping a more inclusive, trusting, and empowering financial landscape for the future.